The Rise of Digital Finance: Exploring the Future of Cryptocurrency in Online Transactions

The financial landscape is undergoing a massive transformation with the rise of digital finance, particularly the growing use of cryptocurrency in online transactions. Once a niche concept limited to tech enthusiasts and early adopters, cryptocurrencies like Bitcoin, Ethereum, and stablecoins have rapidly gained mainstream attention. As digital currencies evolve, their impact on online transactions, e-commerce, and global financial systems continues to grow.

This article delves into the current trends shaping the future of cryptocurrency in online transactions, its benefits, challenges, and what the rise of digital finance means for businesses and consumers alike.

The Growth of Cryptocurrency in Online Transactions

Over the last decade, cryptocurrency has moved from the fringes of financial systems to becoming a prominent player in online transactions. Major companies, including PayPal, Tesla, and Overstock, have begun accepting cryptocurrencies as payment. With global e-commerce reaching trillions of dollars in sales annually, the potential for cryptocurrency to play a major role in the digital economy is vast.

One reason for the growing adoption of digital currencies is the increasing demand for decentralized, secure, and fast payment options. Traditional banking systems often involve fees, delays, and restrictions, especially when it comes to international transfers. Cryptocurrencies, however, offer a more streamlined alternative by eliminating intermediaries and providing faster, more secure payments.

With blockchain technology powering cryptocurrencies, transparency and security are vastly improved compared to traditional financial transactions. Each transaction is encrypted and recorded on a public ledger, reducing the risk of fraud and manipulation. This transparency has garnered trust from both consumers and businesses, contributing to the increased use of cryptocurrency in day-to-day online purchases.

The Benefits of Cryptocurrency for Online Transactions

There are several advantages to using cryptocurrency in online transactions, for both merchants and consumers. Some of the key benefits include:

- Lower Transaction Fees: One of the biggest benefits of cryptocurrency is the potential for lower transaction fees. Traditional payment processors often charge significant fees for international transactions or large payments. Cryptocurrencies, on the other hand, can offer low or even zero transaction fees depending on the blockchain and network congestion.

- Faster Payment Settlements: Cryptocurrency transactions are processed quickly compared to traditional methods, especially for international transfers. Unlike bank transfers, which can take several days to process, crypto payments are often completed within minutes or hours, making them ideal for time-sensitive transactions.

- Global Accessibility: Cryptocurrencies offer a solution to the problem of accessibility in the global financial system. Many people, especially in developing nations, do not have access to traditional banking services. However, anyone with an internet connection and a digital wallet can access and use cryptocurrencies, democratizing financial systems globally.

- Enhanced Security: Cryptocurrency transactions are secure, thanks to the blockchain’s immutable and decentralized nature. This level of security helps prevent identity theft, fraud, and chargebacks, providing peace of mind for both buyers and sellers.

- Privacy: While not entirely anonymous, cryptocurrencies provide more privacy than traditional payment methods. Users can make transactions without having to share sensitive personal or financial information, which is appealing to individuals concerned with privacy in the digital age.

Challenges Facing Cryptocurrency in Online Transactions

Despite the benefits, there are also challenges that hinder the widespread adoption of cryptocurrency in online transactions. Some of these challenges include:

- Price Volatility: Cryptocurrencies are known for their extreme price volatility. This volatility makes it difficult for businesses to price their goods and services in crypto or for consumers to use it as a stable store of value. Stablecoins, which are pegged to fiat currencies, have emerged as a solution to this problem, but volatility remains a concern for many.

- Regulatory Uncertainty: Cryptocurrencies operate in a regulatory gray area in many countries. Governments around the world are still figuring out how to regulate digital currencies, with some embracing them and others banning or restricting their use. This uncertainty can create risks for businesses and consumers looking to adopt cryptocurrency for online transactions.

- Adoption Barriers: While cryptocurrency adoption is growing, it’s still not universally accepted. Many consumers and businesses are hesitant to embrace it due to lack of understanding, concerns over security, or the perceived complexity of using crypto for payments.

- Energy Consumption: Some cryptocurrencies, particularly Bitcoin, have come under scrutiny for their high energy consumption. The environmental impact of mining and processing transactions is a growing concern, leading to calls for more eco-friendly alternatives, such as proof-of-stake consensus mechanisms.

The Future of Cryptocurrency in Online Transactions

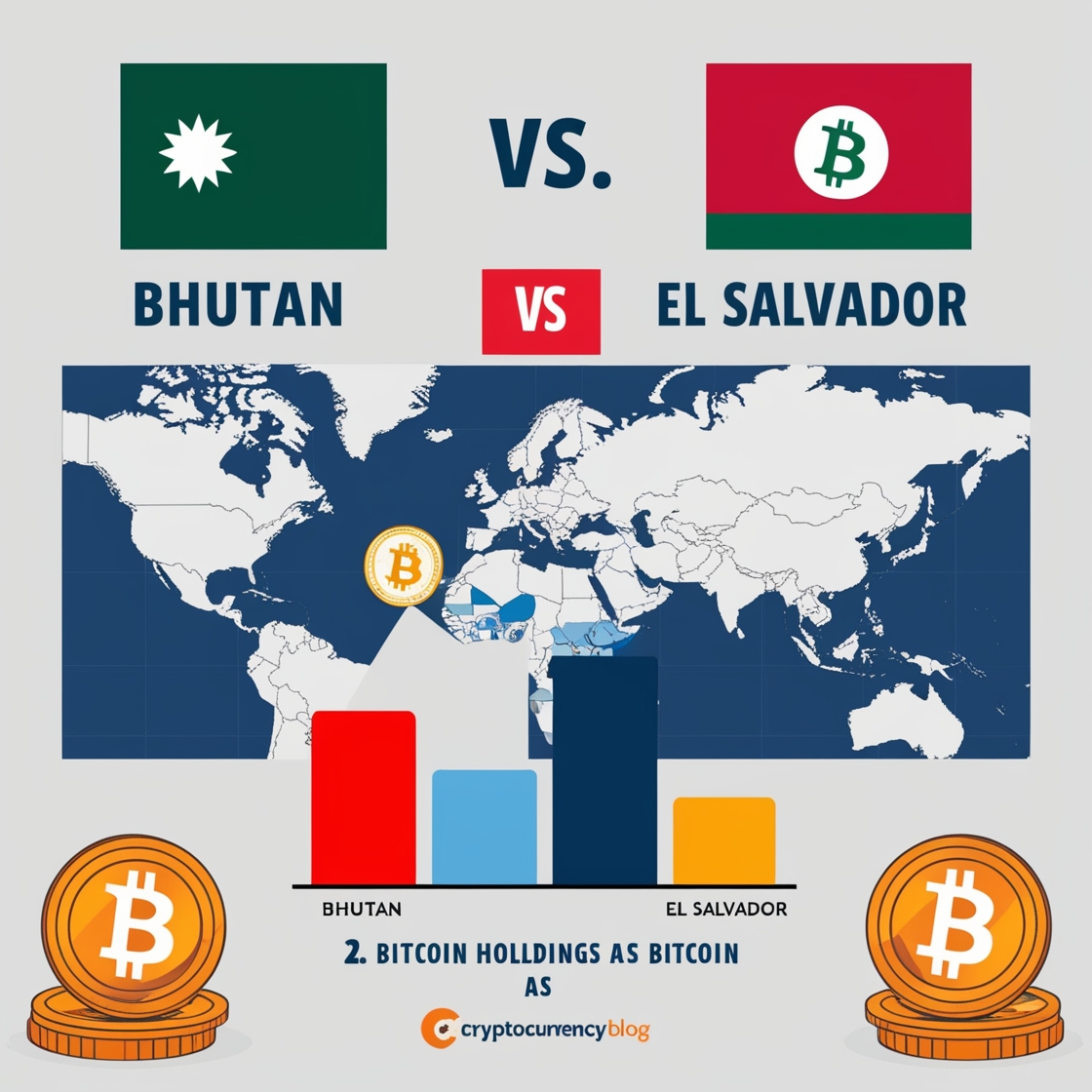

As digital finance continues to evolve, it is clear that cryptocurrency will play a significant role in shaping the future of online transactions. Major financial institutions are exploring blockchain technology, and businesses are integrating cryptocurrencies into their payment systems. Governments are also taking notice, with some central banks even developing their own digital currencies (CBDCs).

As regulatory frameworks become clearer and technology continues to improve, the barriers to widespread cryptocurrency adoption will likely diminish. Innovations like stablecoins and decentralized finance (DeFi) platforms are addressing many of the challenges associated with cryptocurrencies, offering more stable and accessible alternatives.

Moreover, the increasing integration of cryptocurrency into mainstream payment systems, e-commerce platforms, and mobile wallets points to a future where digital currencies become a common, if not dominant, form of payment for online transactions.

The rise of digital finance and the growing use of cryptocurrency in online transactions represent a significant shift in the global financial system. While challenges such as price volatility, regulatory uncertainty, and adoption barriers remain, the benefits of using cryptocurrency—such as lower fees, faster settlements, and enhanced security—are undeniable.

As we look to the future, it is clear that cryptocurrency will continue to gain traction in the online marketplace, offering consumers and businesses more flexibility, security, and freedom in their financial transactions.