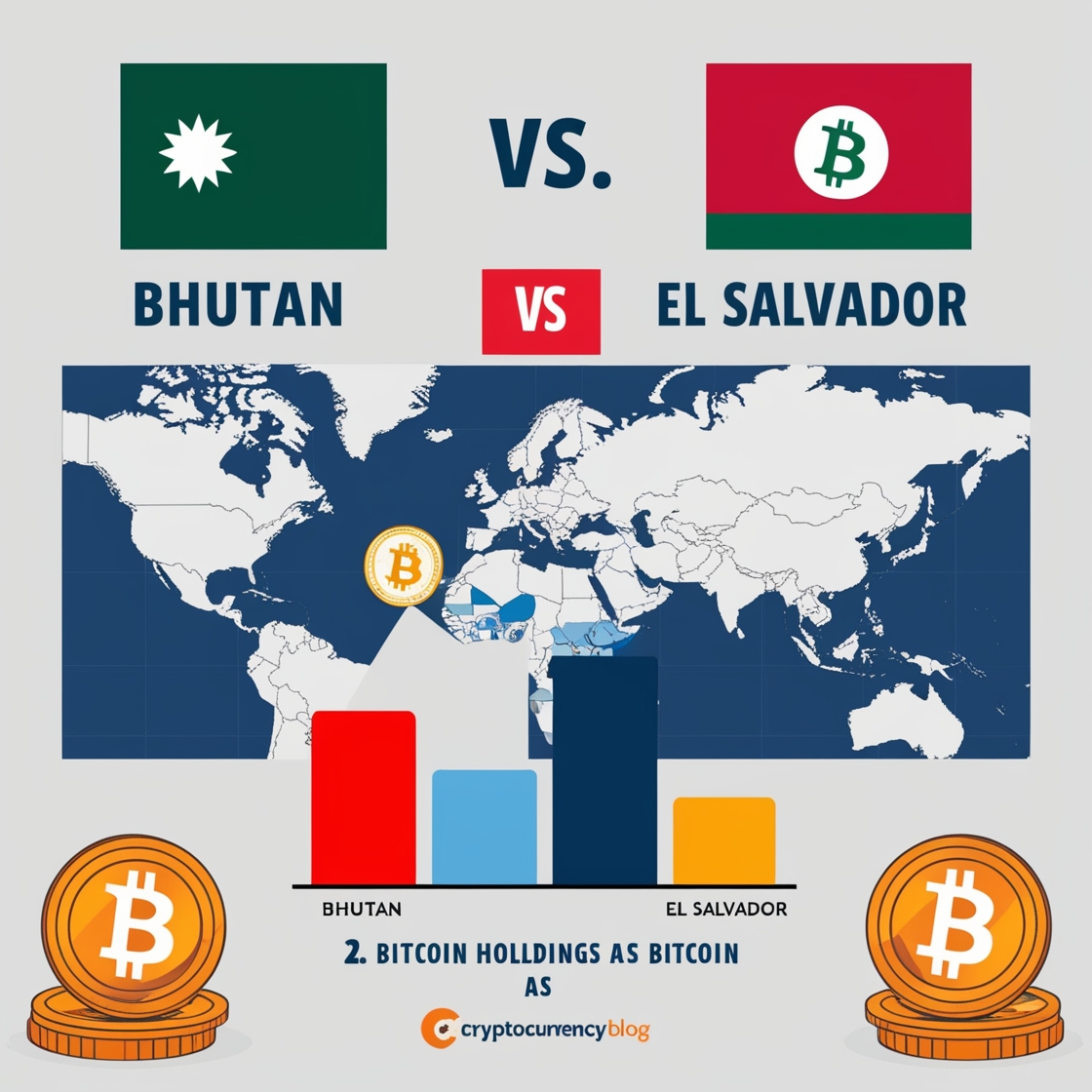

Bhutan’s Bitcoin Holdings Double That of El Salvador, According to Arkham Analysis

In a surprising revelation from Arkham Intelligence, Bhutan has been reported to hold twice as much Bitcoin as El Salvador, making headlines in the cryptocurrency world. This striking comparison not only highlights Bhutan’s growing involvement in digital assets but also raises questions about the strategic choices of both nations regarding Bitcoin. This post delves into the details of Bhutan’s Bitcoin holdings, the context of El Salvador’s Bitcoin strategy, and the implications for the global cryptocurrency market.

Bhutan’s Bitcoin Holdings: A Strategic Move?

According to Arkham Intelligence, Bhutan has accumulated a substantial amount of Bitcoin, reportedly holding twice as much as El Salvador. This finding is particularly noteworthy given Bhutan’s unique position in the global financial and cryptocurrency landscapes.

Bhutan, a small Himalayan kingdom known for its focus on Gross National Happiness, has made a significant investment in Bitcoin. The country’s involvement in cryptocurrency is part of a broader strategy to leverage its clean energy resources. Bhutan’s abundant hydroelectric power provides a sustainable energy source for Bitcoin mining, aligning with its environmental goals and boosting its economic position through digital assets.

The decision to amass Bitcoin may be part of a long-term economic strategy, positioning Bhutan to benefit from potential appreciation in Bitcoin’s value. By holding a substantial reserve of Bitcoin, Bhutan aims to diversify its assets and integrate itself more deeply into the global digital economy.

El Salvador’s Bitcoin Strategy: A Comparative Analysis

El Salvador’s Bitcoin journey has been closely watched since the country became the first to adopt Bitcoin as legal tender in September 2021. President Nayib Bukele’s bold move was intended to boost financial inclusion, attract foreign investment, and harness Bitcoin’s potential to support the national economy.

The Salvadoran government has invested in Bitcoin as part of its strategy to foster economic growth and stability. However, despite its pioneering role in cryptocurrency adoption, El Salvador’s Bitcoin holdings are reportedly less than Bhutan’s. This discrepancy raises questions about the effectiveness and sustainability of El Salvador’s Bitcoin strategy.

El Salvador’s approach involves using Bitcoin to facilitate remittances, promote tourism, and develop a Bitcoin-backed bond called the “Bitcoin Bond” to fund infrastructure projects. While the country has made headlines for its innovative use of Bitcoin, the fluctuations in Bitcoin’s value and the ongoing challenges in implementing the cryptocurrency on a national scale have prompted debates about the viability of its strategy.

The Global Impact of Bhutan and El Salvador’s Bitcoin Holdings

The revelation of Bhutan’s larger Bitcoin holdings compared to El Salvador underscores a shift in the global cryptocurrency landscape. Both countries’ approaches to Bitcoin highlight different strategic priorities and potential outcomes.

- Economic Diversification: Bhutan’s investment in Bitcoin represents a diversification of its economic assets, leveraging its clean energy resources to create a new revenue stream. This approach aligns with Bhutan’s broader economic goals and offers a model for other nations with renewable energy resources to explore similar opportunities.

- Financial Inclusion: El Salvador’s Bitcoin adoption aims to improve financial inclusion by providing a new avenue for people to participate in the digital economy. While the country’s approach has faced challenges, it remains a pioneering example of how Bitcoin can be integrated into a national financial system.

- Market Influence: The differing Bitcoin holdings of Bhutan and El Salvador may influence market perceptions and investor behavior. Bhutan’s larger reserve could signal confidence in Bitcoin’s long-term value, potentially impacting market dynamics and encouraging other nations to consider similar strategies.

Implications for the Cryptocurrency Market

The comparison of Bitcoin holdings between Bhutan and El Salvador reflects broader trends in the cryptocurrency market. As countries explore and implement Bitcoin strategies, their decisions have significant implications for global crypto markets and financial systems.

- Increased Institutional Interest: Bhutan’s substantial Bitcoin holdings may attract the attention of institutional investors looking to understand how small nations are leveraging digital assets. This could lead to increased institutional interest in Bitcoin and other cryptocurrencies.

- Regulatory Considerations: The strategies of Bhutan and El Salvador highlight the need for clear regulatory frameworks for cryptocurrencies. As more nations engage with Bitcoin, developing comprehensive regulations will be crucial to ensure stability and mitigate risks associated with digital asset investments.

- Future Trends: The differing approaches of Bhutan and El Salvador may set precedents for other countries exploring cryptocurrency adoption. Bhutan’s focus on sustainable energy and El Salvador’s integration of Bitcoin into its financial system provide valuable insights into the potential benefits and challenges of digital asset investments.

The recent analysis by Arkham Intelligence revealing that Bhutan holds twice as much Bitcoin as El Salvador offers a fascinating perspective on the global cryptocurrency landscape. Bhutan’s strategic investment in Bitcoin, supported by its clean energy resources, contrasts with El Salvador’s pioneering but challenging integration of Bitcoin as legal tender.

As both nations continue to navigate the complexities of cryptocurrency adoption, their experiences will provide valuable lessons for other countries considering similar paths. The global cryptocurrency market is evolving rapidly, and the strategies of nations like Bhutan and El Salvador will play a key role in shaping its future.